Inclusive Insurance Innovation Lab

How can we increase uptake of good quality insurance by vulnerable people and businesses?

Insurance protects against unforeseen losses and financial vulnerability and plays a vital role in promoting economic growth. Yet in most developing and emerging economies, insurance penetration rates are low and vast segments of the low-income population as well as micro and small businesses remain excluded from insurance.

The Inclusive Insurance Innovation Lab was designed as a sequence of national workshops and international platforms for insurance supervisors and other key stakeholders of the inclusive insurance sector. It provides a unique opportunity to build leadership capabilities while working together to develop innovative solutions that will increase uptake of insurance. The process started in 2017 to 2018 with the initial Inclusive Insurance Innovation Lab by the Access to Insurance Innitiative (a2ii) in cooperation with the Global Leadership Academy. It then took flight, as a2ii continues with a second and third cohort from 2020 onwards, see below.

Dates and Locations

“We all hold a piece of the puzzle to find the solution.”

31

Participants

The participants represent all important insurance stakeholders such as companies, intermediaries, regulatory authorities and demand side representatives.

4

Countries

Albania, Ghana, Kenya, Mongolia

The Process

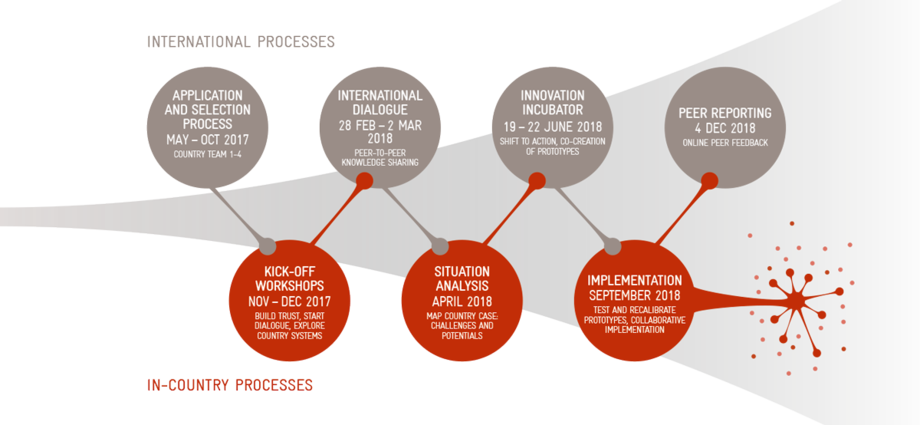

To address the challenges in improving access to insurance, the Access to Insurance Initiative and the Global Leadership Academy launched a unique 12-month Leadership and Innovation Lab. The Lab brought together a broad range of inclusive insurance stakeholders in 4 country teams to build innovative solutions, guided by the question: How can we increase uptake of good quality insurance by vulnerable people and businesses?

The Inclusive Insurance Innovation Lab is based on the understanding that the question above cannot be tackled by one stakeholder alone. Rather, it needs the collective experience from diverse perspectives to comprehensively understand the bottlenecks within the sector.

Building on this understanding, the process enables participants to develop and test innovative solutions to promote uptake of insurance by those in need.

The Lab aims at:

Oftentimes stakeholders in the insurance market have preconceived conceptions about one another and do not adequately understand the challenges and constraints that the other actors face. The Lab will stimulate dialogue and an exchange of experiences, both within and across country teams. This will allow participants to learn from the experience of other countries (i.e. peer learning) and to thoroughly understand the perspectives of all players in the inclusive insurance market – a prerequisite to creating sustainable innovation. The process aims to develop lasting networks within (and across) the participating countries which can be drawn on even after the Lab process has come to an end.

In a first step, country teams will collectively analyse their country context in order to identify the specific areas in which innovation is needed. In a second step, the process will enable teams to develop innovative solutions that can increase the uptake of insurance by vulnerable people and businesses. Initial implementation of the innovations will be accompanied by experienced change facilitators – but ownership ultimately rests with the country groups.

The knowledge gained and skill sets developed throughout the Lab will help participants address complex realities in their future work. The entire process is designed to promote leadership and innovation skills and the ability of participants to initiate multi-stakeholder collaboration.

“This is the first time we are meeting like this. We all know each other, but have never met all together!”

Impact

The Global Leadership Academy's objective is to enable change on a personal, organisational, and systemic level. The Migration Laboratory takes an emergent approach to change – it doesn't formulate the objectives for change initiatives, instead, the Lab provides an enabling space where new ideas can be sparked, networks created and paths to change tried and tested.

The iii-lab met the objectives that it had set out to achieve, which were to (1) promote dialogue and mutual learning amongst key stakeholders of the inclusive insurance sector, (2) inspire participants to take action, and (3) equip participants to assume leadership within their sector and/or organisation.

outcomes per category

While the innovative solutions and implementation of prototypes are the primary outcomes of the iii-lab, the iii-lab also created more far-reaching and long-term outcomes. By rallying team members around a common cause, it created networks, changed perceptions and led to spin-off innovations by one or several team members that were initially not planned. The outcomes of the lab can be grouped into nine categories:

- Strengthening the supervisors’ central role in promoting market development

- Promoting change within the insurance sector

- Developing innovative solutions and first prototypes

- Creating strong intra-country networks

- Fostering peer exchange and support

- Strengthening individual knowledge and leadership skills

- Promoting change within organisationsLinking to other in-country policy, regulatory and development initiatives

- Strong country ownership of the process

outcomes per country

As of 2019

Barriers: Limited product range; No targeting of products at different consumer groups, such as farmers

Innovations: Development of insurance products for the agricultural sector (greenhouse protection, index product for seedlings)

Other iii-lab outcomes: Greater awareness amongst insurers about inclusive insurance and needs of different consumer groups

Inclusive insurance and agricultural insurance now included in AFSA strategy

Greater coordination with other government institutions ð Ministry of Agriculture planned subsidies for agricultural insurance.

Institutionalisation: through the Insurance Association of Albania and its Product Development Committee.

And in 2021

- Continued contact amongst Lab members.

- Lab discussions and results still relevant.

- Continued focus on strengthening collaboration between various insurance stakeholders.

- Activities undertaken to increase insurance awareness, financial education, and trust in the insurance market.

- AFSA and the Insurance Association continue to work together towards market and product development (products tailored to the needs of customers).

- Considering to pursue collaboration with the Kenya team on agricultural insurance after COVID 19.

As of 2019

Barriers: Lack of insurance awareness and/or negative perceptions of insurance; Limited understanding of the needs of different consumer groups, such as micro and small business (MSB) owners.

Innovations: MSB clinics to identify risks of small business owners, develop needs-based insurance solutions & raise awareness amongst business owners of insurance as a risk management tool. An electronic complaints & rating platform to boost customer confidence. Modelling a ‘seamless customer journey’ in microinsurance.

Other iii-lab outcomes:

MSB clinics and customer journey included in new strategic plan of the NIC to increase insurance penetration.

Revision of the insurance law influenced by the iii-lab.

Insurance-related revisions to the National Financial Inclusion Strategy (NFIS) have been proposed.

Institutionalisation: Four working groups were established (lab team members + other stakeholders) to reach clear goals: (1) MSB clinics (with a focus on informal trade associations), (2) IT (incl. e-complaints platform), (3) Marketing and education and (4) Customer journey standards.

And in 2021

• Ongoing bilateral interactions between lab members and with other teams (other teams asking about experience in Ghana).

• MSB clinics piloted successfully in Accra with GIZ (HQ) funding.

• MSME insurance still relevant topic (collaboration with GIZ project on the topic).

• MicroEnsure in 2020 focus on insurance for SMEs, influenced by lab discussions around customer-centricity and pain points. Received a $100,000 grant from UNCDF on „SME recovery from COVID" based on MSB clinics concept, onboarded 3000 MSBs on free insurance (12 months) and designed some product aspects influenced by lab discussions.

• Insurance regulation in Ghana is still being revised with an Insurance Act passed in December 2020. Regulations and Directives to the Act will deal with market conduct issues and „pain points“ (incl. those identified by the „customer journey team“ of the lab.

• Lab discussion around partnerships have made an impact on new partnerships, for example with NGOs.

As of 2019

Barriers: Lack of trust in insurers; New and efficient distribution channels are not being explored sufficiently. Innovation needs to be institutionalized in the insurance sector.

Innovations: Development of a regulatory sandbox. Innovative partnerships for insurance (nanolenders, MNOs and Fintechs to develop products suitable for their large customer bases).

Other iii-lab outcomes: IRA plans to develop an innovation hub. Linkages to the Government‘s „Big Four“ agenda (food security, manufacturing, low cost housing, universal health care) are being explored. Significant peer support provided to other iii-lab teams.

Institutionalisation: Branding for iii-lab (logo and flyer; co-financed by team members). Proposal for longer-term support from IRA and insurance association. Innovation hub to be established within IRA. Various organisations and companies interested in partnering with the iii-lab members.

And in 2021

Bimabox, a regulatory sandbox was launched in June 2020.

Bimalab: InsurTech accelerator platform is being launched in 2021, supported through UK Kenya Tech Hub & industry (e.g. Prudential offering a catalyst fund for winners) using the social lab methodology and with original iii-Lab members taking a role for participants and linking Bimalab to Bimabox. The UK Kenya Tech Hub is looking to replicate the Bimalab idea across SSA (included in strategic plan).

As of 2019

Barriers: Lack of insurance awareness and negative perception of insurance; Limited access to insurance beyond the capital city, Ulaanbaatar.

Innovations: Insurance game application for mobile phones to improve insurance awareness; Inclusive insurance roadmap linked to the country’s NFIS; Development of an inclusive insurance logo; ‘Insurance Supermarket’ (internet platform to compare inclusive insurance products).

Other iii-lab outcomes: The mid-term strategic plan of the FRC that extends until 2025 now includes a focus on increasing insurance penetration and advancing inclusive insurance in Mongolia.

The definition of inclusive insurance has changed.

Paperless policies are now possible under the updated regulation (pending parliamentary approval).

Overall industry cooperation improved visibly.

An inclusive cancer product has been launched.

Activities to increase insurance awareness carried out.

Institutionalisation: A roadmap for inclusive insurance development for Mongolia and integration into the NFIS is planned. Team meetings continued. The iii-lab team developed a vision for 2022: The goal is to increase the insurance penetration rate from the current 0.4% to 1% or more by the year 2022 and to enable at least 80% of the people in Mongolia to have access to insurance.

And in 2021

The Financial strategy plan covered insurance and financial education issues and integrated learnings from the iii-lab experience.

FRC approved sandbox regulation.

The concept of financial inclusion (including financial education and SME insurance) has gained importance in Mongolia.

The number of inclusive insurance products is inceasing in Mongolia, from 7 to 12-13 inclusive products (11 of them officially registered), incl. personal accident, child accident insurance, home-owners insurance and COVID cover. „COVID cash“ covers COVID-related costs e.g. for medicine etc. that exceed state health insurance coverage. Plans for an inclusive personal accident cover for truck drivers in mining area have been made

New products were developed by the National life insurance, like an inclusive cancer product, a COVID insurance product for state employees (no fee for the employees) and first insurance cover against COVID as well as a new endowment life policy that has been developed as alternative to decreasing bank interest rates.

The „Insurance supermarket“ software app is making work much easier; agents helping clients file claims through the software.

Discussions within lab team resulted in change within the industry (e.g. less exclusions; waivers of subrogation now included). This might be summarized as a mindset change: „the industry became one team“.

The Second Inclusive Insurance Innovation Lab (2020-2021)

Following the initial cohort and pilot descirbed above, the Acess to Insurance Initiative decided to continue with the Lab format and launched the Second iii-Lab in March 2020, which due to the Covid 19 pandemic was moved entirely online and continues until September 2021. Again teams in four countries were working on innovative solutions, guided by the leading question: How can we develop our insurance markets?

Find out more about the process, the learning about conducting the lab online and prototypes developed on the Lab's website.

40

Participants

The participants represent all important insurance stakeholders such as companies, intermediaries, regulatory authorities and demand side representatives.

4

Countries

Argentina, India, Morocco, Rwanda

The Third Inclusive Insurance Innovation Lab (2021-2022)

The series of successful Inclusive Insurance Innovation Labs will be continued by a2ii with the third cohort starting in October 2021 and dedicated to the question: How can we help to increase resilience of the most vulnerable segments in our societies against the impacts of climate change through innovative insurance solutions?

This time country teams from Costa Rica, Grenada, Zambia and Zimbabwe will work together and share their experience from diverse perspectives to comprehensively understand the bottlenecks within the sector.

Our Partners

We implement all our programmes in cooperation with our internationally renowned partners with whom we share our passion for dialogue and change and our commitment to high quality standards.